|

| Todays Run Cash “Dash to the Crash” |

The largest companies in three of the most important leading sectors of the market have seen their executives classified as insiders sell more than 120 million shares of stock over the last six months. Top executives at these very same companies bought just 38,000 shares over that same time period, making for an eye-popping sell to buy ratio of 3,177 to one.

The grand total for the three sectors are “as awful as we have ever seen since we began doing this exercise years ago,” said Newman, who was ahead on such trends as the dangers of high-frequency trading and ETFs before the ‘Flash Crash’. “Clearly, insiders are seeing great value only in cash. Their actions speak volumes for the veracity for the current rally.”

In fact, the flush-with-cash CEOs continue to blame the consumer class for joblessness. Despite the mass exodus of executives from their own company’s stock, the S&P continues to remain somewhat stable since gaining 16% from July lows.

|

| The Real Market |

Well, those gains seem somewhat pathetic since the value of the dollar — measured against the human inflation indexes such as food and oil — has plummeted.

Major food commodities are up over 50% since their July lows, while oil prices have climbed $10 to over $81/bbl, or around 14% for the same time period, with predictions to break the $100/bbl mark very shortly.

Read on more of this Spoooky post from activistpost.com – booo (hoo 😉

Read on more of this Spoooky post from activistpost.com – booo (hoo 😉

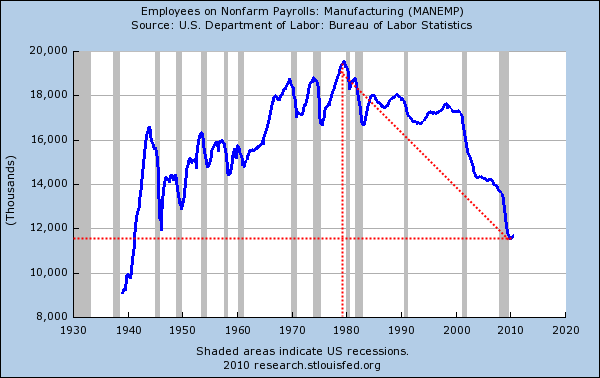

- (CBS) The economic jam we’re in has topped even the Great Depression.

- Unemployment has been at nine and a half percent or above for 14 months.

- Unemployment benefits to run out after 99 weeks that cost a massive debt over $100 billion to already broken tax payers

- FORECLOSURE FRAUD & $45 TRILLION DOLLARS

The EPA maintains State Resource Locators and contact information for several topics: Air Quality – Ambient

The EPA maintains State Resource Locators and contact information for several topics: Air Quality – Ambient

Connect with EHS News